All Categories

Featured

[/image][=video]

[/video]

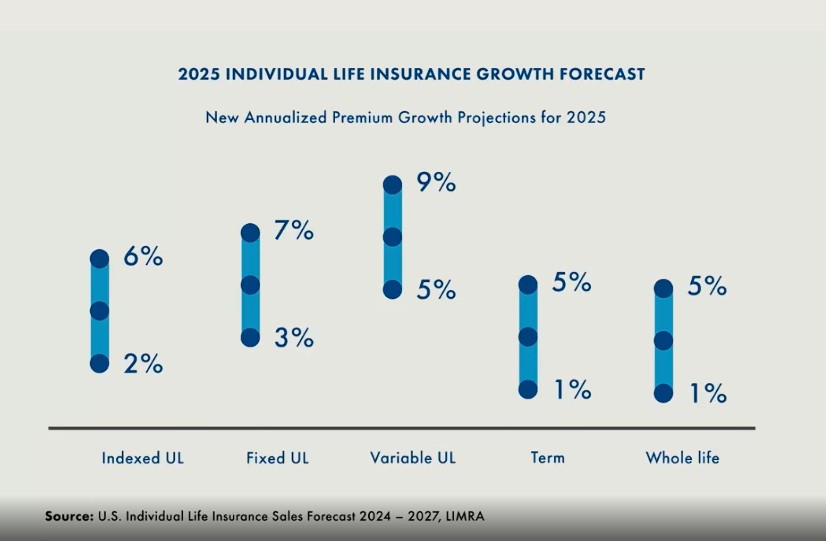

In 2025, LIMRA is projecting FIA sales to go down 5%-10% from the document set in 2024 yet continue to be over $100 billion. RILA sales will note its 11th successive year of record-high sales in 2024.

LIMRA is projecting 2025 VA sales to be degree with 2024 outcomes. After record-high sales in 2023, income annuities propelled by engaging demographics patterns and eye-catching payout rates need to surpass $18 billion in 2024, setting another record. In 2025, lower rates of interest will certainly force carriers to drop their payout rates, resulting in a 10% cut for income annuity sales.

It will be a blended outlook in 2025 for the overall annuity market. While market problems and demographics are really positive for the annuity market, a decrease in rate of interest (which propelled the amazing growth in 2023 and 2024) will damage set annuity items proceeded development. For 2024, we expect sales to be greater than $430 billion, up between 10% to 15% over 2023.

The firm is additionally a hit with agents and customers alike. "Allianz is incredible," John Stevenson, proprietor and expert at Stevenson Retirement Solutions, told Annuity.org. "They're A+ rated. A great deal of my customers like that and they agree to approve a bit lower of a revenue due to that.

The business rests atop the most current version of the J.D. Power Overall Consumer Fulfillment Index and flaunts a strong NAIC Issue Index Rating, also. Pros Sector leader in client complete satisfaction Stronger MYGA rates than a few other extremely rated business Cons Online item info could be stronger A lot more Insights and Experts' Takes: "I have actually never had a negative experience with them, and I do have a number of delighted clients with them," Pangakis stated of F&G.

The firm's Secure MYGA includes advantages such as riders for terminal disease and nursing home arrest, the capability to pay the account value as a survivor benefit and prices that go beyond 5%. Couple of annuity firms succeed more than MassMutual for clients who value financial stamina. The business, started in 1851, holds a prestigious A++ rating from AM Finest, making it one of the best and best companies offered.

Future Mutual Income Annuity

Its Secure Voyage annuity, for example, offers a conventional means to generate revenue in retirement combined with manageable surrender charges and numerous payment alternatives. The business likewise markets registered index-linked annuities via its MassMutual Ascend subsidiary.

"Nationwide stands out," Aamir Chalisa, basic manager at Futurity First Insurance Team, informed Annuity.org. "They have actually obtained fantastic consumer solution, a really high ranking and have been around for a number of years. Whether you want to create earnings in retired life, expand your cash without a whole lot of danger or take benefit of high prices, an annuity can properly accomplish your goals.

Fers Annuity Supplement Calculator

Annuity.org laid out to recognize the top annuity companies in the sector. To accomplish this, we made, evaluated and executed a fact-based method based upon key sector factors. These consist of a company's monetary strength, schedule and standing with customers. We likewise called several industry professionals to get their takes on different business.

Latest Posts

Temporary Annuity

Bonds Vs Annuities

Jackson Variable Annuity Performance